Recensioni(2)

laboratori, discussione aperta

Renata Ostrowska - BFF Polska S.A.

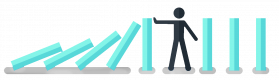

Corso - Planning and Risk Assessment

Traduzione automatica

Hakan era molto entusiasta e competente

Hugo Perez - DENS Solutions

Corso - Project Risk Management

Traduzione automatica

Corsi in Arrivo

Fine settimana Risk Management corsi, Sera Risk Management training, Risk Management centro di addestramento, Risk Management con istruttore, Fine settimana Risk Management training, Sera Risk Management corsi, Risk Management coaching, Risk Management istruttore, Risk Management trainer, Risk Management corsi di formazione, Risk Management classi, Risk Management in loco, Risk Management corsi privati, Risk Management training individuale